Frequently Asked Questions About Estate Planning: Essential Guidance for Illinois Residents

Estate planning is the process of arranging how your assets, healthcare decisions, and guardianship matters will be handled if you become incapacitated or after you die, and this guide focuses on practical, Illinois-specific answers to common estate planning questions. By reading this article you will learn what documents and strategies typically belong in a plan, how wills and trusts differ under Illinois rules, when probate applies and how to reduce its impact, the role of powers of attorney and advance directives, when plans should be updated, and the main cost drivers and special considerations to expect in Illinois. Many Illinois residents face confusion over probate, asset titling, digital accounts, and how to protect loved ones; this FAQ-style guide offers clear definitions, step-by-step process descriptions, and actionable next steps you can take. The content pulls together legal concepts, statutory considerations, and practical examples so you can evaluate which tools fit your situation and know when specialized help is useful. Read on for concise answers, comparison tables, checklists, and examples tailored to common Illinois scenarios.

What Is Estate Planning and Why Is It Important?

Estate planning is the set of legal decisions and documents that specify how your assets, medical choices, and personal care will be managed and distributed when you are unable to act or after your death. This planning works by naming decision-makers (agents, executors, trustees) and arranging legal structures (wills, trusts, beneficiary designations) that produce predictable outcomes, reduce family conflict, and preserve value. The primary benefit is control: a properly structured plan preserves your intent for guardianship, asset protection, and healthcare directions while easing administrative burdens for survivors. Recent studies and practice trends show that planning reduces estate administration time and legal friction, which is particularly valuable for Illinois residents managing real estate, business interests, or blended-family circumstances. Understanding the core components clarifies practical next steps and leads naturally into a breakdown of common documents used in modern estate planning.

What Does Estate Planning Include?

Estate planning typically combines written directives, fiduciary appointments, and transfer mechanisms to achieve personal and financial goals. Common documents and mechanisms include wills, trusts, powers of attorney, healthcare directives, and beneficiary designations that together determine who controls assets, who decides about health care, and who cares for minor children. The mechanism of a trust, for example, allows assets to be managed by a trustee for beneficiaries and can bypass probate, while beneficiary designations and joint ownership create non-probate transfers that pass automatically. These instruments work together: a will handles residuary distributions and guardianship, a power of attorney covers financial decisions, and an advance directive addresses medical preferences. Knowing these pieces helps you choose the right combination for your priorities and prepares you for the next step: deciding whether you need an estate plan in Illinois.

The following list summarizes typical estate planning components and their primary purpose:

- Will: Directs final distribution and names an executor and guardians for minors.

- Trust: Holds assets for beneficiaries and can provide privacy and probate avoidance.

- Durable power of attorney: Appoints someone to manage finances if you are incapacitated.

- Healthcare directive / living will: States medical treatment preferences and names a healthcare agent.

These documents fit together to form a cohesive plan, and understanding each piece supports selecting the best mix of tools for your situation. The next section explains common situations that indicate who should create a plan in Illinois.

Who Needs an Estate Plan in Illinois?

Many people assume estate planning is only for the wealthy, but virtually anyone with financial accounts, real estate, dependents, or healthcare preferences benefits from a plan. Typical scenarios that make planning essential include owning a home or business, caring for minor children or a family member with special needs, having retirement accounts or life insurance, or wanting to control healthcare decisions in case of incapacity. Even younger adults with modest assets should consider basic documents to name an agent and avoid guardianship proceedings; the process prevents unnecessary court involvement and confusion. Debunking myths helps focus on practical triggers: it is not wealth alone but ownership type, family structure, and medical decision-making preferences that determine planning needs. With that clarity, the next section compares two foundational tools—a will and a trust—to help you weigh the trade-offs for Illinois situations.

What Are the Differences Between a Will and a Trust?

A will is a directive that takes effect at death and generally requires probate, while a trust is a legal arrangement that can manage assets during life and distribute them privately, often avoiding probate. Wills are simpler to draft and are the primary vehicle for naming guardians and an executor, but they become public through probate and may not control assets that pass by beneficiary designation or joint ownership. Trusts—especially revocable living trusts—offer ongoing management, privacy, and smoother transfer of titled assets, but they often require more upfront effort to fund and can involve additional trustee administration. Deciding between a will and a trust depends on your goals for privacy, continuity, asset types, and complexity; the table below highlights core differences to aid quick comparison.

This table shows that wills and trusts serve different roles: wills provide clarity for guardianship and residual distributions, while trusts offer control, privacy, and probate avoidance when funded correctly. The following subsections explain Illinois formalities for wills and the common trust types you may encounter.

What Is a Will and How Does It Work in Illinois?

A will is a legal instrument that directs how probate assets are distributed, names an executor, and allows appointment of guardians for minor children, and Illinois law requires certain formalities for a will to be valid. In Illinois, a valid will must be in writing, signed by the testator (or at the testator’s direction), and witnessed by at least two competent witnesses who sign in the testator’s presence; unsworn affidavits and self-proving mechanisms can streamline probate. The executor has duties to inventory assets, notify beneficiaries, pay debts and taxes, and distribute the estate under court supervision unless non-probate transfers apply. Understanding these formal execution rules helps avoid common pitfalls like improper witnessing or failing to update beneficiary designations, and leads naturally to considering trusts for cases requiring probate avoidance and ongoing management.

What Is a Trust and What Types Are Available?

A trust is an arrangement where a settlor transfers assets to a trustee to hold and manage for beneficiaries according to trust terms, and trusts come in several types with distinct purposes and trade-offs. Common hyponyms include revocable living trusts (for continuity and probate avoidance while retaining control), irrevocable trusts (for asset protection and estate tax planning), special needs trusts (to preserve government benefits), and testamentary trusts (created by a will at death). Each type has a mechanism and benefit: revocable trusts are flexible but offer limited creditor protection, while irrevocable trusts can remove assets from the settlor’s taxable estate but require relinquishing control. Selecting a trust type depends on goals such as privacy, tax planning, and beneficiary needs, and these choices shape how probate exposure and administration will unfold in Illinois.

How Does the Probate Process Work in Illinois?

Probate is the court-supervised process that validates wills, identifies assets, pays debts and taxes, and distributes the remainder to heirs or beneficiaries; it applies primarily to assets titled solely in a decedent’s name without beneficiary designations. The mechanism of probate works through filing a petition, appointing a personal representative (executor), inventorying assets, notifying creditors, and obtaining court approval for distributions, with timelines varying based on estate complexity and creditor claims. Probate can be necessary for Illinois estates with real property solely in the decedent’s name or bank accounts lacking payable-on-death designations, and understanding the steps helps families plan to minimize delay and expense.

Below is a concise summary of the typical probate steps and the parties responsible for each stage in Illinois.

Understanding these steps clarifies why many people seek probate avoidance strategies, since avoiding probate can save time, preserve privacy, and reduce administrative costs.

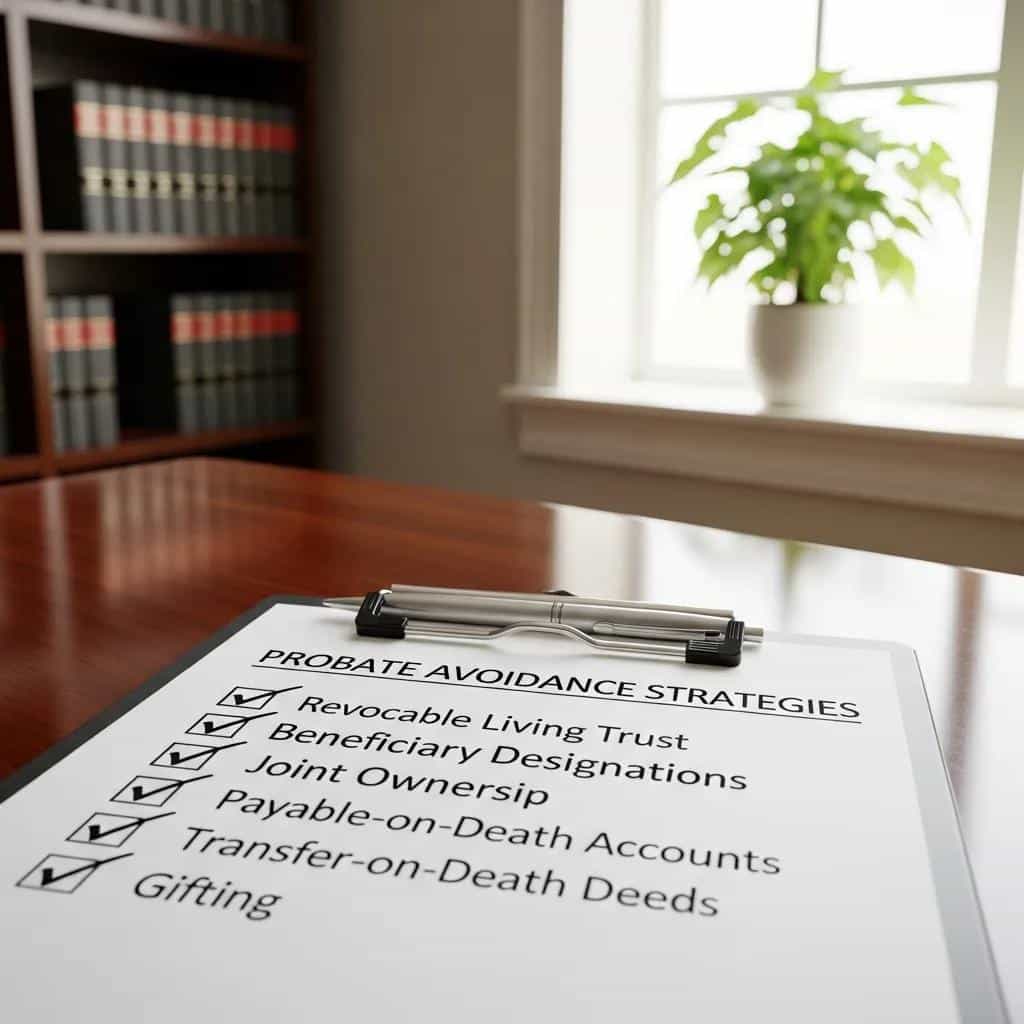

When avoiding probate is a priority, consider the following commonly used strategies:

- Fund a revocable living trust to transfer titled assets into a trust that will pass to beneficiaries without probate.

- Confirm beneficiary designations on retirement accounts and life insurance to ensure they pass directly to named recipients.

- Use payable-on-death or transfer-on-death designations for bank and investment accounts when available.

These options each have pros and cons—trusts can require additional funding work, while beneficiary designations must be kept current to avoid unintended results—so selecting the right combination depends on asset types and family circumstances. The next subsection details which assets typically require probate and which generally pass outside of it.

What Is Probate and When Is It Necessary?

Probate becomes necessary for assets that are titled solely in the decedent’s name without beneficiary designations or joint owners with rights of survivorship, and Illinois real estate owned solely by the decedent is a common trigger. Examples of probate assets include a house held in a sole owner’s name, personal property without transfer instructions, and certain bank accounts not designated as POD/TOD; by contrast, assets with beneficiary designations, joint tenancy, or trust ownership typically avoid probate. The reason probate exists is to provide an orderly, court-supervised method to pay debts and ensure proper distribution to heirs, but its timelines and costs can be burdensome for families without planning. Recognizing which assets fall into each category is the first step toward implementing probate-avoidance strategies explained in the following subsection.

How Can Probate Be Avoided in Illinois?

Probate avoidance in Illinois relies on legal transfer mechanisms such as revocable living trusts, beneficiary designations, joint ownership with rights of survivorship, and statutory transfer-on-death provisions for certain assets. Implementing these strategies requires attention to detail: a trust must be properly funded by retitling assets into the trustee’s name, beneficiary designations must be coordinated with a will to prevent conflicts, and joint ownership should be used carefully because it can create unintended survivor outcomes. Each strategy carries trade-offs—trusts can cost more upfront and need maintenance, while joint ownership may expose assets to a co-owner’s creditors—so choosing the right approach depends on your priorities and complexities. For many Illinois residents, working with an estate planning attorney ensures these mechanisms are drafted and implemented correctly, which reduces the risk of probate, clarifies successor authority, and protects beneficiaries.

What Is a Power of Attorney and Why Is It Important?

A power of attorney (POA) is a legal document that appoints an agent to make financial or medical decisions on your behalf, and durable forms remain effective if you become incapacitated. The key mechanism is delegation: a durable financial POA authorizes an agent to pay bills, manage investments, and handle transactions, while a healthcare POA names a person to make medical choices consistent with your values and advance directive. The specific benefit is continuity—your affairs can be managed promptly without court-appointed guardianship, which reduces delay and expense during crises. Understanding the types and scope of POAs clarifies how to choose agents, tailor authority, and revoke or update powers when life changes occur.

What Types of Powers of Attorney Exist in Illinois?

Illinois recognizes several common POA types, including durable financial powers of attorney for broad fiscal authority and healthcare powers of attorney for medical decision-making, each with specific execution formalities. A durable financial POA can be immediate or springing and allows the agent to handle banking, real estate transactions, and investment management; Illinois statutes provide default duties and standards of care for agents. A healthcare power of attorney accompanies an advance directive or living will and permits an agent to make treatment decisions when you cannot express preferences; the authority can be limited or broad depending on your stated instructions. Choosing the proper type and scope involves balancing trust in the agent, the complexity of your affairs, and protections such as requiring multiple agents or successor agents.

How Does a Living Will Differ from a Power of Attorney?

A living will (advance directive) states your specific treatment preferences—such as life-sustaining measures—while a healthcare power of attorney appoints someone to interpret and implement decisions when you are incapacitated. The living will functions as direct instructions to providers about treatments you would refuse or accept, making it a declarative mechanism, whereas the healthcare POA is an appointment mechanism that entrusts decision authority to a named agent. Both documents work together: the living will guides clinical decisions and the healthcare agent uses that document to make situational choices that preserve your expressed preferences. Knowing this distinction helps you create documents that reflect values and ensure coherent decision-making under Illinois healthcare and surrogate decision frameworks.

When and How Should You Update Your Estate Plan?

You should update your estate plan whenever major life events occur and review documents periodically to ensure they reflect current assets, relationships, and laws; a practical schedule is to review every 3–5 years and immediately after significant changes. Updates are important because beneficiary designations, property ownership, family composition, and statutory rules can change, producing unintended outcomes if documents stay static. The mechanism for updating typically involves executing new wills or amendments (codicils), restating or amending trusts, and revising powers of attorney or healthcare directives with proper execution formalities under Illinois law. Regular reviews and event-triggered updates preserve the plan’s integrity and reduce the risk of probate disputes or benefit interruptions.

What Life Events Require Estate Plan Updates?

Certain life events create immediate need to revise key documents because they alter property rights, beneficiary needs, or decision-makers; these events include marriage, divorce, birth or adoption, death of a beneficiary, substantial asset purchases or sales, and changes in health. For each event, targeted actions may include adding a guardian for new minor children, updating beneficiary designations after a divorce, funding a trust to include newly acquired real estate, or creating a special needs trust for a family member to preserve benefits. Addressing these items promptly reduces uncertainty and ensures that transfer mechanisms operate as intended when needed. The next subsection provides guidance on how frequently to review plans beyond event-driven updates.

Common trigger events that merit immediate document review include:

- Marriage or divorce: update beneficiary designations and executors/trustees.

- Birth or adoption of a child: name guardians and revise distribution plans.

- Major asset acquisition or sale: retitle assets to match trusts or beneficiary designations.

After acting on these triggers, schedule a comprehensive review to confirm all documents coordinate legally and practically.

How Often Should Estate Plans Be Reviewed in Illinois?

A practical review interval is every three to five years and whenever major life or financial events occur; this cadence balances the cost of attorney review with the need to adapt to changes in your situation and Illinois law. Regular review ensures beneficiary designations remain aligned, trust funding is current, and powers of attorney reflect trusted agents; it also allows for tax or statutory adjustments that may affect strategic options. If you experience repeated changes—like business transfers, remarriage, or moves between states—prioritize more frequent updates to prevent gaps in protection and unintended distribution paths. Adopting a proactive review schedule prevents surprises and keeps your plan responsive to evolving priorities.

What Are the Costs and Special Considerations in Illinois Estate Planning?

Costs for estate planning in Illinois vary based on document complexity, whether trusts are used, the need for tax planning, and whether specialized planning—such as special needs trusts or digital asset instructions—is required. The fee drivers include attorney experience, the number and type of documents (simple will vs. multi-document trust package), real estate transfers, and ongoing trustee services; complicated family situations and tax planning needs raise costs. Special considerations include handling digital assets (account inventories, access instructions, digital executors) and drafting special needs trusts to preserve public benefits while providing supplemental support.

Before the table, note that cost ranges are conceptual and illustrate which factors commonly increase fees rather than acting as itemized quotes.

This table makes clear that more tailored solutions—such as trusts with tax or special-needs features—require additional drafting and administration, which drives fees higher than a simple will package. After considering cost drivers, the following subsection explains particular considerations for digital assets and special needs planning and includes practical steps to protect these categories.

What Factors Influence the Cost of Estate Planning in Illinois?

Several variables determine fees: the number and complexity of documents, real estate or business interests requiring title changes, the need for tax planning or irrevocable arrangements, and whether ongoing trustee or guardian oversight is anticipated. Attorney experience and local market conditions also affect rates, as does the need to coordinate with financial or tax advisors for multi-disciplinary planning. Costs increase with added customization—such as drafting spendthrift clauses, drafting specialized trust provisions, or establishing multi-generational planning strategies—and with the administrative work to transfer titles into trusts. Understanding these drivers helps you budget and decide whether phased planning or a full-package approach best matches your priorities.

How Are Digital Assets and Special Needs Trusts Handled?

Digital assets require an inventory, clear access instructions, and designated digital executors to ensure accounts and online property are preserved, transferred, or closed according to your wishes; providers and encryption rules mean practical access planning is essential. Practical steps include creating a secure inventory of account credentials and instructions, appointing a digital executor in writing, and including language in your estate plan authorizing access consistent with service providers’ terms. Special needs trusts are designed to supplement rather than replace government benefits; they must be drafted with specific language to preserve Medicaid and Supplemental Security Income eligibility and administered prudently by a trustee familiar with benefit rules. These specialized documents typically increase planning complexity and may benefit from counsel to balance legal formality with day-to-day administration.

LaCava Law Firm – Illinois Estate Planning & Real Estate Attorney provides tailored estate planning and real estate guidance for Illinois clients, assisting with wills, trusts, powers of attorney, and strategies for probate avoidance and asset protection.

For clients who prefer professional support, the firm emphasizes honest rates and expert guidance, helping implement trust funding, beneficiary coordination, and special needs planning while explaining cost drivers and practical trade-offs.

If you decide you need help converting your planning goals into legally effective documents, scheduling a consultation with an Illinois-focused estate planning attorney can streamline implementation and reduce the risk of costly drafting errors.

For readers ready to take action, the next paragraph explains typical first steps and what to gather before meeting an attorney.

Practical first steps before meeting an attorney include:

- Assemble account lists: list titles, beneficiary designations, and real property details.

- Identify key people: potential agents, trustees, executors, and guardians.

- Clarify goals: privacy, probate avoidance, special needs preservation, or tax planning.

These preparatory steps reduce consultation time and make it easier to obtain a clear, cost-effective plan.

LaCava Law Firm – Illinois Estate Planning & Real Estate Attorney can assist Illinois residents in converting the steps and documents outlined above into a cohesive plan, offering guidance on trust funding, probate avoidance, and special needs trust design consistent with state statutes.

The firm’s focus on tailored solutions, honest rates, and expert guidance is intended to complement the educational material in this guide without replacing the value of individualized legal advice.

If you prefer professional assistance, consider preparing the documents and inventories described here before an initial consultation to make the most of attorney guidance.

This article has presented practical, Illinois-specific answers to common estate planning questions and provided tables, checklists, and actionable next steps to help you evaluate which tools to use. If you need help implementing the approaches discussed—such as drafting a revocable trust, updating beneficiary designations, or creating a special needs trust—an Illinois estate planning attorney can translate your goals into legally effective documents and help avoid mistakes that lead to probate or benefit loss.

Conclusion

Effective estate planning empowers Illinois residents to control their assets, healthcare decisions, and guardianship matters, ensuring their wishes are honored. By understanding the essential documents and strategies, you can minimize probate complications and protect your loved ones. If you’re ready to take the next step in securing your legacy, consider consulting with an experienced estate planning attorney. Explore tailored solutions that fit your unique situation today.